Continuing our journey through the world of dividend aristocrats, we shift our focus to nine more stocks on the renowned list – from NextEra Energy Inc. (NEE) to Genuine Parts Company (GPC). These companies, each with a robust history of consistent dividend growth, offer investors a pathway to stable income and potential capital appreciation. Join us in this comprehensive blog post as we uncover the distinctive characteristics of these influential dividend aristocrats, complemented by a 10-year growth chart showcasing the impact of dividend reinvestment on an initial $10,000 investment.

1. NextEra Energy Inc. (NEE)

- Description: NEE is a clean energy company and one of the largest electric power companies in the United States. With a strong emphasis on renewable energy, NextEra Energy provides investors with exposure to the growing demand for clean power.

- Dividend Yield: 3.3%

- 10-Year Annual Return: 13.85

2. The Coca-Cola Company (KO)

-

- Description: KO is a beverage giant known for its globally recognized brands, including Coca-Cola, Sprite, and Dasani. As a dividend aristocrat, Coca-Cola’s enduring popularity and strong market presence make it a reliable income-generating investment.

-

-

-

- Dividend Yield: 3.1%

- 10-Year Annual Return: 7.56%

-

-

3. Target Corporation (TGT)

- Description: TGT is a retail giant with a vast network of stores offering a wide range of products. Target’s ability to adapt to changing consumer preferences and its solid financial performance contribute to its status as a dividend aristocrat.

- Dividend Yield: 3.1%

- 10-Year Annual Return: 12.36%

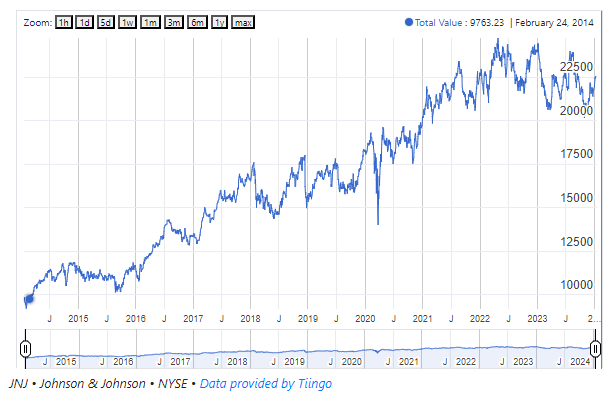

4. Johnson & Johnson (JNJ)

- Description: JNJ is a diversified healthcare company with a focus on pharmaceuticals, medical devices, and consumer health products. With a storied history and a commitment to advancing health for all, Johnson & Johnson is a cornerstone in many dividend portfolios.

- Dividend Yield: 3.1%

- 10-Year Annual Return: 8.51%

5. Cincinnati Financial Corporation (CINF)

- Description: CINF is an insurance company providing a range of property and casualty insurance products. With a disciplined underwriting approach and a history of consistent dividend increases, Cincinnati Financial is a reliable choice for income-focused investors.

- Dividend Yield: 2.9%

- 10-Year Annual Return: 11.02%

6. Atmos Energy Corporation (ATO)

- Description: ATO is a natural gas distribution company serving over three million customers across eight states. As a regulated utility, Atmos Energy provides a stable and predictable source of income for investors.

- Dividend Yield: 2.9%

- 10-Year Annual Return: 12.37%

7. Sysco Corporation (SYY)

- Description: Sysco is a global leader in food distribution, serving restaurants, healthcare facilities, and educational institutions. With a vast distribution network and a focus on efficiency, Sysco has consistently rewarded shareholders with increasing dividends.

- Dividend Yield: 2.49%

- 10-Year Annual Return: 10.76%

8. Automatic Data Processing Inc. (ADP)

- Description: ADP is a prominent provider of human resources, payroll, and benefits outsourcing solutions. As businesses rely on ADP for workforce management, the company’s stability and strong financials contribute to its status as a dividend aristocrat.

- Dividend Yield: 3.2%

- 10-Year Annual Return: 16.01%

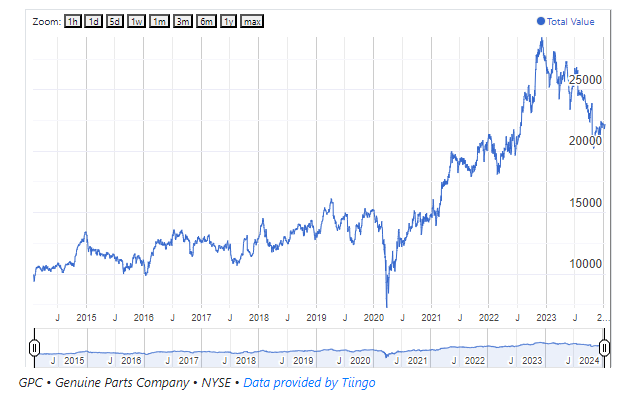

9. Genuine Parts Company (GPC)

- Description: GPC is a distributor of automotive and industrial replacement parts. With a long history and a commitment to excellence, Genuine Parts Company has established itself as a reliable dividend-paying stock.

- Dividend Yield: 2.7%

- 10-Year Annual Return: 8.34%

Conclusion

In conclusion, these 9 dividend aristocrats represent a diverse range of industries, each with its unique strengths and qualities. Investing in dividend aristocrats can provide investors with a reliable income stream and the potential for long-term capital appreciation. As always, it’s crucial for investors to conduct their due diligence and consider their financial goals and risk tolerance before making investment decisions. Whether you’re a seasoned investor or just starting, exploring the world of dividend aristocrats could be a prudent step towards building a resilient and income-generating portfolio.

Leave a Reply